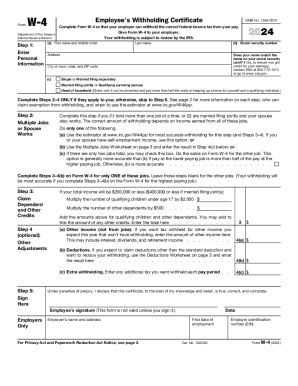

IRS W-4 2025-2026 free printable template

Instructions and Help about IRS W-4

How to edit IRS W-4

How to fill out IRS W-4

Latest updates to IRS W-4

All You Need to Know About IRS W-4

What is IRS W-4?

Who needs the form?

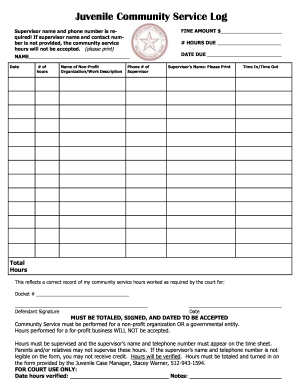

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-4

What should I do if I realize I made a mistake on my IRS W-4 after submission?

If you find an error on your IRS W-4 after you've submitted it, you can correct it by submitting a new W-4 to your employer. Make sure to indicate any changes clearly and ensure your new submission reflects your current tax situation.

How can I track whether my IRS W-4 has been received and processed?

To verify if your IRS W-4 has been processed, contact your employer’s payroll department. They should be able to provide you with the status of your submission. Keeping a record of when you submitted it can also help in this inquiry.

What are some common errors people make on their IRS W-4, and how can I avoid them?

Common errors on the IRS W-4 include incorrect filing status, miscalculating allowances, and failing to sign the form. To avoid these mistakes, carefully review the instructions and double-check your entries before submitting the form to your employer.

Can I e-file my IRS W-4, and what should I consider regarding technical requirements?

While the IRS W-4 is typically submitted directly to your employer rather than filed with the IRS, ensure that any electronic submission method complies with your employer's guidelines. Check your software compatibility and ensure you have the latest version for optimal functionality.

See what our users say